Who Pays the Least Property Tax in Ontario? The Answer may Surprise You

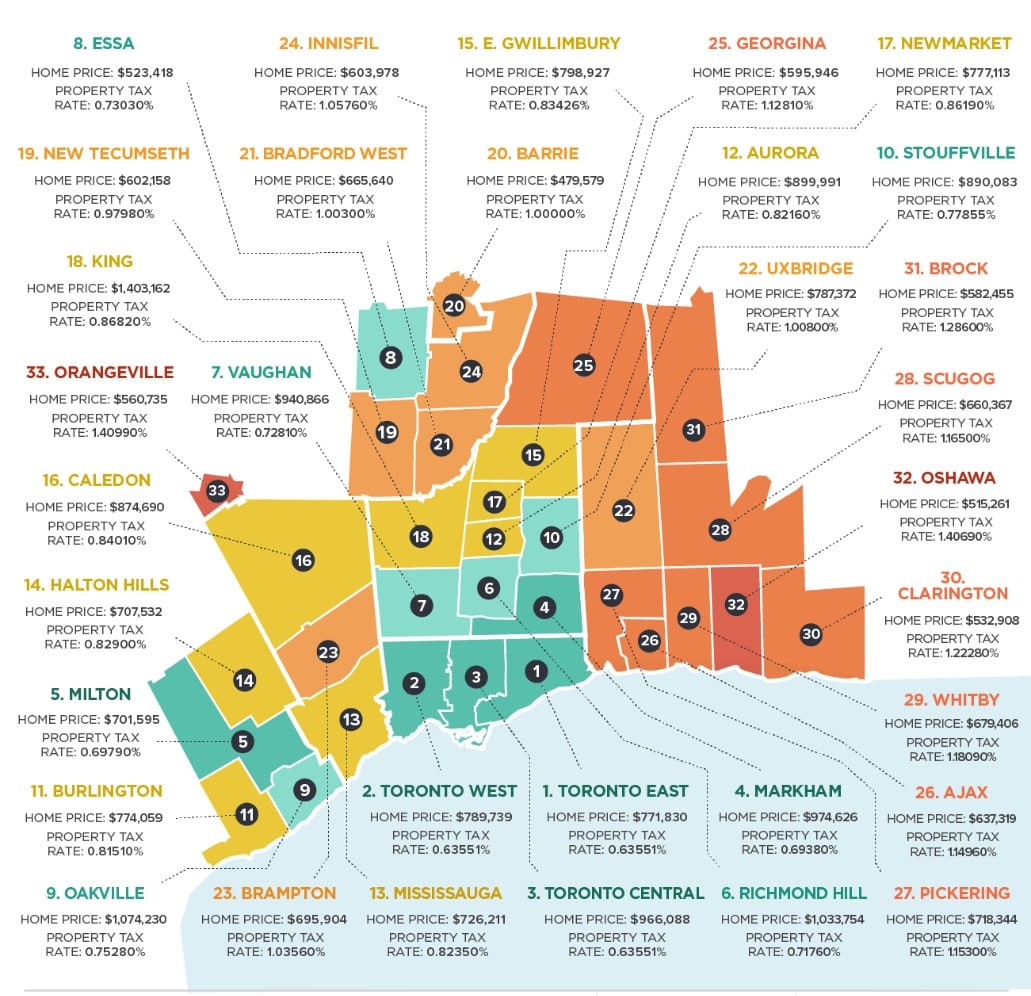

Either you are currently living in Ontario or considering moving to Ontario, you might wonder which cities have the highest and lowest property taxes in Ontario. Property tax rates in Ontario range between 0.59% and 1.78% of your home assessed value. Wonder which city’s rates are the lowest?

How is Ontario’s Property Tax Calculated?

The assessed value of a property determines how much its property tax will be.

In Ontario, the assessed value of properties is done by the Municipal Property Assessment Corporation (MPAC), which uses factors correlated to the market price to determine this value.

Almost for all cities in Ontario the municipality assessed property value is lower than the property’s market price. The ratio of property taxes in Ontario to the fair market value of the property is less than 1%. However, when you compare the property tax to the assessed value of a property, the ratio for some cities in Ontario will become larger than 1%.

Toronto property taxes – photo credit Toronto.ca

Which City Has the Lowest Property Tax?

The housing market in Toronto may be one of the hottest in the country, but Toronto property tax is the lowest in Ontario in comparison to both the fair market and assessed values. For a house with an assessed value of $500,000 in Toronto (e.g. market price of $750,000) with a property tax rate of 0.59%, the property tax is about $3,000.

Here are some factors responsible for Toronto’s low property tax: a dense city structure, relatively high real estate prices, and municipal land transfer tax. Toronto land transfer tax is unique since all other cities in Ontario only have provincial land transfer tax but Toronto land transfer tax is a combination of both provincial and municipal land transfer taxes.

When comparing the property tax rate in other Ontario cities e.g. Windsor, at 1.78% of home prices (for a home valued at $500,000 you would pay a property tax of almost $9,000) to that of Toronto; you need to also consider that Windsor has a less dense city structure and lower real estate prices.

Comparing Property Taxes in Toronto and Vancouver

Although the property tax rate in Toronto is one of the lowest in Ontario, it is still not as low as Vancouver’s property taxes. One reason for Vancouver’s low rates could be its mild weather. While cities in Ontario generally require more maintenance during its cold winter, British Columbia’s weather means it would need little maintenance, thus it has less need for property tax.

Recently however, Vancouver’s home prices have grown significantly, and their growth has been faster than any cities in Canada in the last 10 years.

Toronto Needs Better Infrastructure…

Toronto homeowners often feel like the low tax rate is good news, but it comes at a cost: the cost of poor city service provision e.g. the Toronto subway system, road networks, and recreational facilities.

If Toronto increases property tax so as to spend more on infrastructure e.g. fixing the city’s subway system, increasing the number of highways, it would be a step in the right direction, as the number of highways almost has not been increased within the last decade in spite of significant population growth.

Conclusion

- Property tax is calculated based on a municipal property assessed value

- A property’s assessed value is less than its fair market value in Ontario

- In Ontario, Toronto has the lowest property tax rate, almost 1/3 of what Windsor residents pay.

- The property tax rate in Toronto can however be increased so as to spend more on the city’s infrastructure e.g. the subway system, number of highways etc.